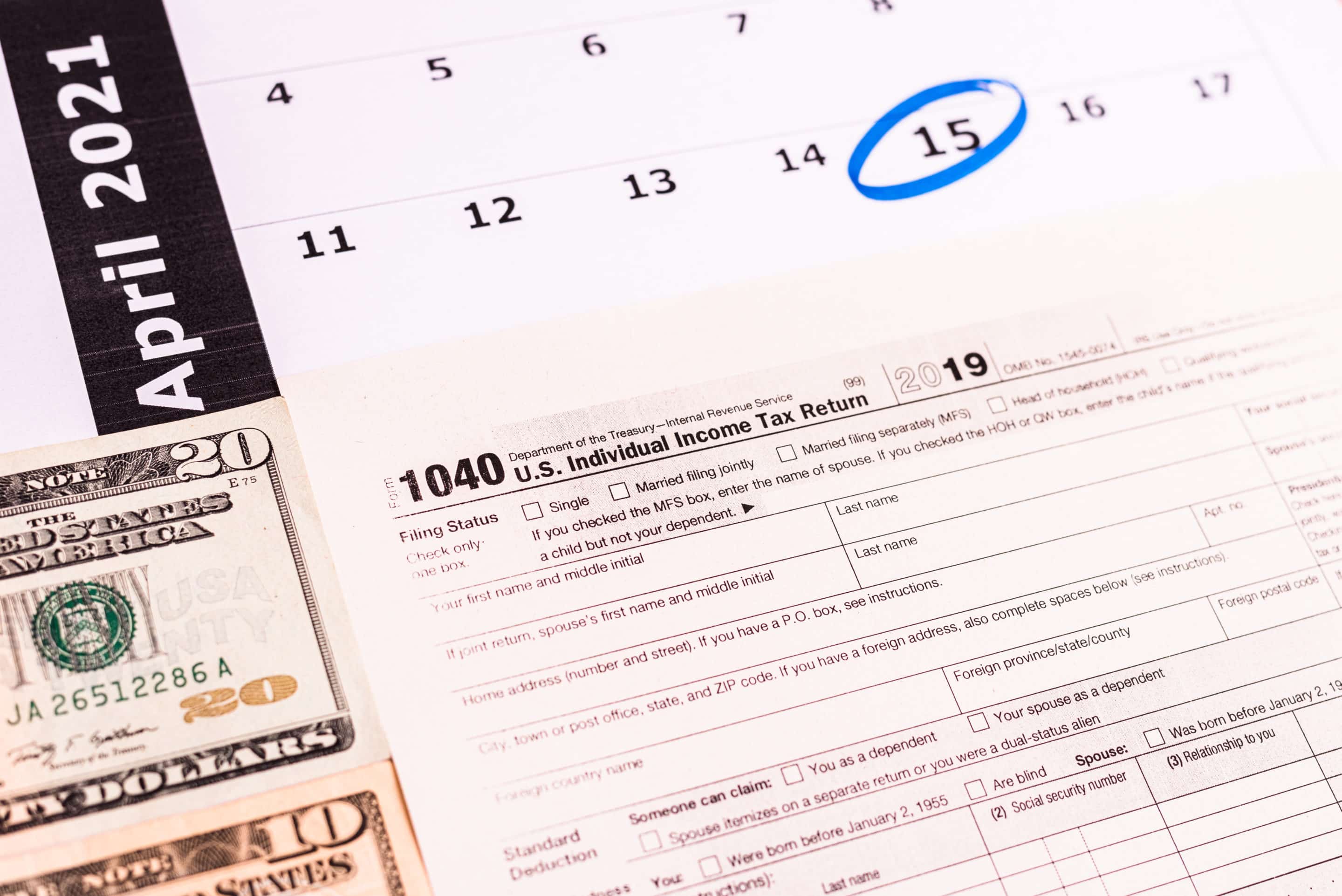

Last day to file taxes through Form 1040 is April 15th.

April 15th is the deadline to file your taxes, but sometimes life gets in the way and you need a little extra time. If you find yourself in this situation, don’t worry, you can file for an extension. Here’s everything you need to know about filing an extension on your taxes.

April 15th is the deadline to file your taxes, but if you can’t make it, you can file for an extension

If you can’t make the April 15th deadline to file your taxes, don’t worry – you can always file for an extension. An extension will give you an extra six months to get your affairs in order and submit your return. Keep in mind, however, that even though an extension gives you additional time to file your return, it does not extend the deadline for paying any taxes owed. So if you think you’re going to owe money come tax time, be sure to pay at least that amount by April 15th or you may be subject to penalties and interest charges.

To file for an extension, you need to fill out Form 4868 and submit it by the April 15th deadline

If you’re not able to file your taxes by the April 15th deadline, you can always request an extension. All you need to do is fill out Form 4868 and submit it by the deadline. This will give you an extra six months to file your return. Keep in mind, however, that this is only an extension of time to file – not an extension of time to pay any taxes owed. So if you think you’ll owe money come tax time, it’s best to start making arrangements now so that you don’t end up with a hefty bill down the road.

If you’re approved for an extension, you will have until October 15th to file your taxes

If you’re approved for an extension, you will have until October 15th to file your taxes. This may come as a relief to many taxpayers who may not be able to complete their tax returns by the April deadline. There are a few steps you need to take in order to apply for an extension, and we’ve outlined them throughout this piece. You should only request an extension if you truly cannot meet the April 15th deadline – otherwise, late fees may apply.

Want to make sure you’re all squared away? Check with Greenblatt Financial and we can help keep you in sound standing!